Requirements For Journal Transfers Involving Recharge Accounts

What is Changing

Effective FY24, UCOP has instituted a Common Chart of Accounts (CCoA) across the UC System, in conjunction with a new UCOP Financial System. One of the changes required by the new UCOP Financial System is a requirement that recharge debit/credit balances must net to zero across all recharge accounts. This has required UCSC to create specific account codes to be used for recharge activity, and to create journal voucher edits to ensure that recharge debit/credits stay in balance. Prior to this change, the account used on the debit side of a recharge transaction did not have to be classified as a recharge account; going forward it does.

To accomplish this in FIS Banner, Enterprise Financial Systems, along with Central Accounting and Budget Analysis and Planning have created new recharge account codes (account codes starting with ‘X’) containing specific mapping restricting their use with new journal voucher rule codes.

General Information

- Rule codes XTOR and XECR have been created for use with new recharge account codes. If a journal transfer must be completed involving recharge account codes (similar to a XTOE), rule code XTOR must be used. If any of the funds are Contracts and Grants related, XECR must be used. For example, if you are transferring a recharge expense from one org code to another, you must use XTOR/XECR because the FOAPAL will involve a recharge account code.

- Recharge transfers must be made across recharge account codes (eg, a transfer cannot be made from X09000 to 000010).

- Approval queues for XTOR and XECR are the same as XTOE and XECG, respectively.

- XTOE and XECG rule codes have been updated to disallow usage of recharge account codes.

- All other transfers should be completed using existing rule codes. Additional rule code information can be found here.

- Budget transfers using recharge/internal transfer account codes do not have these restrictions, and can be used with rule codes XTOF and XDCG. For additional questions regarding budget transfers, please contact ask-bap-group@ucsc.edu.

Rule Codes

Rule Codes Recording

FIS Recharge Rule Codes Recording

Rule Code Entry Errors

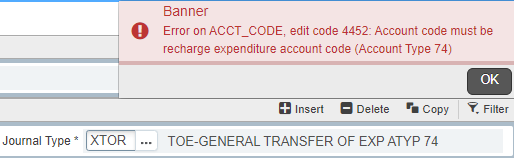

Disallowed account code on a recharge rule code

When attempting to use a disallowed account code on a recharge rule code in FIS Banner, users will receive the following message:

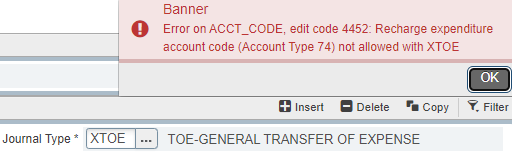

Disallowed account code on a non-recharge rule code

When attempting to use a disallowed account code on a non-recharge rule code in FIS Banner, users will receive the following message:

Rule Code Crosswalk

| Non-Recharge Rule Code |

Description |

| XTOE - TOE-GENERAL TRANSFER OF EXPENSE |

Transfer of non-Recharge Expense (Non-Contracts and Grants) |

XECG - TOE-C&G & SPEC'L

STATE APPROP. |

Transfer of non-Recharge C&G/Special State Appropriations Expense |

| Recharge Rule Code |

Description |

XTOR - TOE-GENERAL

TRANSFER OF EXP ATYP 74 |

Transfer of Recharge Expense (Non-Contracts and Grants) |

XECR - TOE-C&G & SPEC'L

STATE APP ATYP 74 |

Transfer of Recharge expenses for C&G/Special State Appropriations |

If you are unsure of the correct rule code to use, please contact fis_probs@ucsc.edu.

Recharge Account Code Crosswalk

Below is a list of new recharge account codes, and their existing corresponding values (if applicable). New recharge account codes can only be used with newly created recharge rule rodes XTOR, XECR, and existing recharge rule codes (e.g. XBAY, XPDR, etc).

Please note the former recharge account codes will be terminated in the near future, except for accounts that might be needed for external, non-recharge expenses (eg 002580 - Reproduction & Photocopy services) that will continue to be used for services procured through an external vendor.

| Account Code |

Account Description |

New Recharge Account Code |

New Description |

| 001050 |

Workstudy Admin Charges) |

X01050 |

Rchg - Workstudy Admin Charges |

| 001180 |

Custodial Services |

X01180 |

Rchg - Custodial Services |

|

|

X01215 |

Rchg - BAP Approved Contribution |

| 001253 |

Student Programming Events |

X01253 |

Rchg - Catering |

| 001261 |

Miscellaneous Services Recharge |

X01261 |

Rchg - Approved Misc Debit |

| 001265 |

Administrative Services Recharge |

X01265 |

Rchg - Admin Overhead |

| 001290 |

Campus Moving |

X01290 |

Rchg - Moving/Surplus Svcs |

| 001470 |

ITS Data Center Services |

X01470 |

Rchg - ITS Data Ctr/Cloud Svcs |

| 002200 |

Tel Monthly |

X02200 |

Rchg - ITS Network/Telecomm Svcs |

|

|

X02335 |

Rchg - Fingerprinting Svcs |

| 002340 |

Express Mail Services |

X02340 |

Rchg - Mail Services |

| 002400 |

Parking permits-Reserved Space |

X02400 |

Rchg - Parking |

| 002560 |

Media-Educational TV/AV Service |

X02560 |

Rchg - ITS Instr & Media Tech Svcs |

| 002580 |

Reproduction & Photocopy services |

X02580 |

Rchg - Copy Center |

| 004600 |

Garage Charges |

X04600 |

Rchg - Fleet Services |

| 008050 |

Fuel Oil |

X08050 |

Rchg - Fuel Oil |

| 008200 |

CAMFAC-Repair & Maint. Recharge |

X08200 |

Rchg - Bldg & Utility Svcs |

|

|

X08210 |

Rchg - PP&C Services |

| 008220 |

Groundskeeping Services |

X08220 |

Rchg - Grounds Services |

| 008240 |

Sanitation/Refuse Disposal Service |

X08240 |

Rchg - Refuse/Recycling Svcs |

| 008300 |

Space Rental - Recharge |

X08300 |

Rchg - Space Rental |

Budget Analysis And Planning Communication To Recharge Units

Budget Analysis and Planning has sent a notification to recharge units with additional information about recharge interface transactions that post to FIS Banner. Please see below for the text of this communication.

July 24th, 2023 Communication: Recharge Updates

Dear campus collegues,

I'm reaching out to you all in an attempt to contact all the folks involved in internal billing through recharges (including recharge administrators, business managers of miscellaneous fee billing, auxiliary billing, bookstore, catering etc.). Please share this email with folks in your unit who may have been missed, and my apologies for leaving anyone out.

As some of you are aware at the start of FY24 all UC locations, including our campus, will be required to translate all financial activity to a new systemwide common chart of accounts (CCoA). In addition to a new CCoA mapping that for the most part happens behind the scenes, new financial requirements have been established by the Office of the Systemwide Controller in conjunction with the implementation of the CCoA. The new systemwide financial requirement that campus users will confront the most, is that specific recharge/internal transfer debit and credit account codes must net to zero. I'm writing to ask that you incorporate these new account codes in the processing of your recharge transactions as soon as possible. I understand not all of you may have been made aware of this new requirement, and that in the beginning of implementation recharge transactions may be miscoded. Those recharge transactions already processed in FY24 out of compliance with this new requirement will need to be identified and corrected by close of period 12 in fiscal year 2024. Necessary corrections will be facilitated by BAP and other central offices.

Effective in FY24:

- The new recharge/internal transfer account codes will all reside under Account Type 74.

- These new account codes will all begin with 'X' to facilitate clarity and communication regarding new requirements on the use of these account codes.

- Old recharge specific non ‘X’ account codes (e.g. 009000, 001261, 001265, etc) will ultimately be phased out.

- The new Account Type 74 recharge/internal transfer account code transaction amounts must net to zero on the same financial journal (e.g. XTOE). This new financial requirement is not applicable to budget journals.

- The rule class codes you use to upload recharge billing journals to FIS will be restricted to the new Account Type 74 recharge/internal transfer account codes. Use of the new recharge/internal transfer account codes are not limited to recharge activities reviewed by the Direct Costing Committee. Other activities including, but not limited to, auxiliary enterprises and miscellaneous fee activities reviewed by MCFAC legitimately processing recharge transactions will also be responsible for utilizing these new recharge/internal transfer account codes.

- All recharge credits will be collected as recharge revenue on X09000.

- The corresponding debits will go out to your recharge customers in the appropriate internal debit account code matching your activity, or the general one: X01261 "Approved Misc. Debit".

- Recharge transfers to the capital project/plant ledgers (i.e. orgs 97xxxx) will not utilize the new Account Type 74 recharge/internal transfer account codes. Recharge debits on capital projects will continue to be recorded to appropriate CIP account codes with the credit offset recorded to account code 009200.

For any questions, please contact Budget Analysis and Planning at ask-bap-group@ucsc.edu.

Intercampus Transfer Account Code Information

UC System Assessments and Recharges

Certain assessments and recharges from the UC Office of the President will be recorded in their own unique account codes.

Intercampus Order/Charge (IOC)

Expenses and recharges between UCSC and other UC campuses and UC entities handled through the IOC process will now be recorded using transfer account codes specific to each campus location, reflecting the direction of expense movement.

The account codes used for these intercampus transfers, listed below, will be prohibited from use with departmental rule codes (e.g. XTOE, XECG) in FIS. This is done to ensure our campus is able to accurately reconcile intercampus transfers with the other campuses, a requirement of CCOA.

If a department needs to change the fund, org or activity code associated with any of the account codes below, they may reach out to Financial Accounting and Reporting (FAR) (accounting@ucsc.edu) for assistance.

| Account Code |

Account Code Description |

Associated Budget Pool |

| 001266 |

Charges associated with the UC Systemwide Assessment |

B03000 |

| 001267 |

Charges associated with the UCPath Systemwide Assessment |

B03000 |

| (TBD) |

Charges associated with the UCOP General Counsel Assessment |

B03000 |

| (TBD) |

Recharges from the UCOP General Counsel |

B03000 |

| T0800C |

Recharges and expenses to UCOP Location J |

B09000 |

| T0800D |

Recharges and expenses from UCOP Location J |

B03000 |

| T0801C |

Recharges and expenses to UC Berkeley |

B09000 |

| T0801D |

Recharges and expenses from UC Berkeley |

B03000 |

| T0802C |

Recharges and expenses to UC San Francisco |

B09000 |

| T0802D |

Recharges and expenses from UC San Francisco |

B03000 |

| T0803C |

Recharges and expenses to UC Davis |

B09000 |

| T0803D |

Recharges and expenses from UC Davis |

B03000 |

| T0803D |

Recharges and expenses from UC Davis |

B03000 |

| T0804C |

Recharges and expenses to UC Los Angeles |

B09000 |

| T0804D |

Recharges and expenses from UC Los Angeles |

B03000 |

| T0805C |

Recharges and expenses to UC Riverside |

B09000 |

| T0805D |

Recharges and expenses from UC Riverside |

B03000 |

| T0806C |

Recharges and expenses to UC San Diego |

B09000 |

| T0806D |

Recharges and expenses from UC San Diego |

B03000 |

| T0808C |

Recharges and expenses to UC Santa Barbara |

B09000 |

| T0808D |

Recharges and expenses from UC Santa Barbara |

B03000 |

| T0809C |

Recharges and expenses to UC Irvine |

B09000 |

| T0809D |

Recharges and expenses to UC Irvine |

B03000 |

| T0811C |

Recharges and expenses to UC Merced |

B09000 |

| T0811D |

Recharges and expenses to UC Merced |

B03000 |

| T0812C |

Recharges and expenses to Agricultural and Natural Resources (ANR) |

B09000 |

| T0812D |

Recharges and expenses to Agricultural and Natural Resources (ANR) |

B03000 |

| T0814C |

Recharges and expenses to UC Office of the President |

B09000 |

| T0814D |

Recharges and expenses from UC Office of the President |

B03000 |