Employees Nearing Max Vacation Status

With UCPath being the office of record for accruals, the information below explains what to expect when you are nearing your maximum vacation balance in UCPath.

During the period employees are less than 1-accrual period from reaching their maximum vacation balance and have reported takes in the previous period (month/Quadraweekly), they should expect to receive a partial accrual. This is because any takes reported for the prior period (month/Quadraweekly) have not yet been deducted from the UCPath accrual bank. There will be a re-calculation of the following period (month/Quadraweekly) after which the prior month's takes are finally recorded by UCPath.

Employees who did not have any takes in the prior period (month/Quadraweekly) will not have the partial accrual re-calculated, because there were no takes to reconcile. Unless the employee has followed the maximum vacation exception process, the missed accrual will be lost to them.

An extension bank is required to prevent loss of accruals.

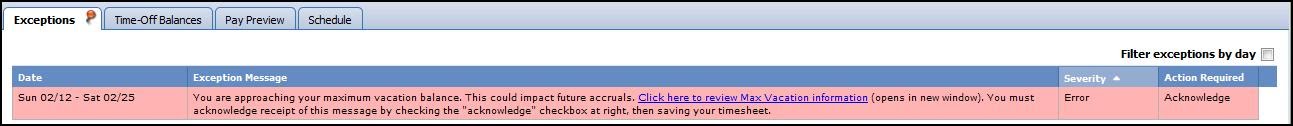

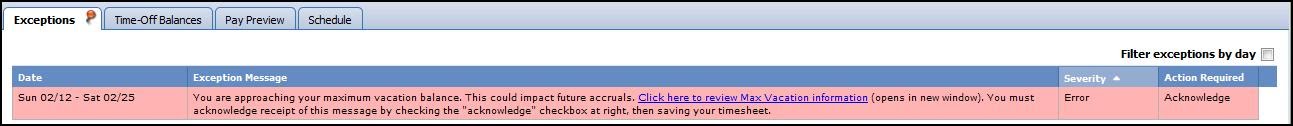

When you are within the maximum vacation notification period, CruzPay will fire an exception message informing you. Once this message fires, you will need to acknowledge it by clicking the Acknowledge box. The exception provides information on accessing this site for more information.

If you are granted an exception to the maximum vacation threshold, you should be working with your supervisor on a plan to bring your vacation balances below the maximum. The following steps should be followed to report vacation hours during the extension period.

click to view full size image

click to view full size image

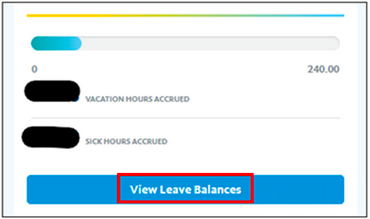

Please Note: UCPath is the office of records and its best practice to review your balances from the Dashboard once signed into UCPath.

click to view full size image

click to view full size image

Once you reach the maximum threshold, CruzPay will no longer accrue vacation hours for you.

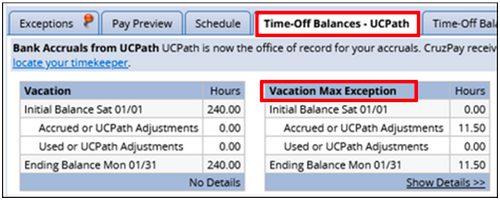

Once the exception is granted, your Timekeeper will work with UCPath to generate the Vacation Extension Hours bank in your Time-Off Balances tab on your timesheet.

click to view full size image

click to view full size image

Please Note: UCPath is the office of records and its best practice to review your balances from the Dashboard once signed into UCPath.

click to view full size image

click to view full size image

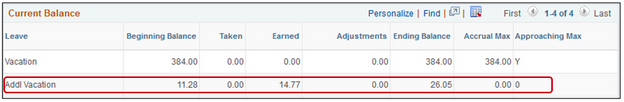

You will also see these hours in UCPath as shown below.

click to view full size image

click to view full size image

Reporting vacation hours taken:

- Use the Vacation Taken paycode to report the number of elapsed hours you are using each day. (Exempt employees report absences in whole-day increments.)

- Save the entry.

Hours in the Vacation Extension Hours bank must be used before hours are deducted from your Vacation Bank.

Once your extension period has ended and you have not reduced your balance below the maximum, future vacation accruals will be suspended until you are below your maximum.

Accrual and/or usage posting timing in CruzPay:

Biweekly:

Biweekly employees: Leave takes (e.g. VAC, SICK) are sent to UCPath shortly after the close of each pay period (typically 3-4 days). UCPath processes the leave takes (used) within 10 days of the close of the pay period (+/- a couple days). Leave Accruals are generated by UCPath once per Quadriweek period (two BW cycles = 1 Quadriweek period), within 10 days (+/- a couple days) of the end of each Quadriweek. These leave accruals are then posted to CruzPay within 1-3 days (11-13 days after the end of each Quadriweek), and are able to be used retroactively to the first day of the Quadriweek after they are earned.

Monthly:

Monthly employees: Leave takes (e.g. VAC, SICK) are sent to UCPath the month after they are used, around the 20th (+/- a couple days). UCPath processes them 10-15 days later, between the first and fifth of the next month. UCPath will therefore have a record of your leave around the 5th of the month (+/- a couple days), two months after you took the leave. Example: vacation taken in December is submitted by the employee by December 31. Supervisors approve by January 2. The December takes are then sent to UCPath on or around January 20. UCPath processes these December takes between February 1-5. Monthly employees can therefore expect to see leave usage updating leave balances within 2 months of using the leave.

For frequently asked questions regarding accruals, please visit Accruals in the CruzPay Frequently Asked Questions guide or contact your timekeeper.